Magazine

Do You Thrive To Learn More About How To Achieve Greater Business Success?

Sign up to our magazine designed specifically for Australian business leaders.

Published on 19 January 2022

by Saul Segal

Categories: Wealth

A recent Federal Court tax case is a sobering reminder you and your spouse cannot take asset protection for granted.

In the Commissioner of Taxation v Bosanac [2021] FCAFC 158, the court made a judgment against the taxpayer for unpaid taxes. It established that a $4.5 million property acquired in the name of one spouse (despite being divorced) was jointly owned 50/50. This allowed the tax office to recover the debt by attacking the family home that was not in the taxpayer’s name.

In light of the above decision and an increasingly litigious business environment, it is very important that you take the time to properly protect your assets and plan for passing on your wealth to future family generations.

While no-one can give you a 100% guarantee about asset protection, the below process may maximise the probability that the equity in your family home will be protected.

Also, if you have significant equity in your business, motor vehicles, boats, loans to your business, jewellery and other assets, we can also make recommendations to you to consider this strategy in order to maximise the protection of these family assets.

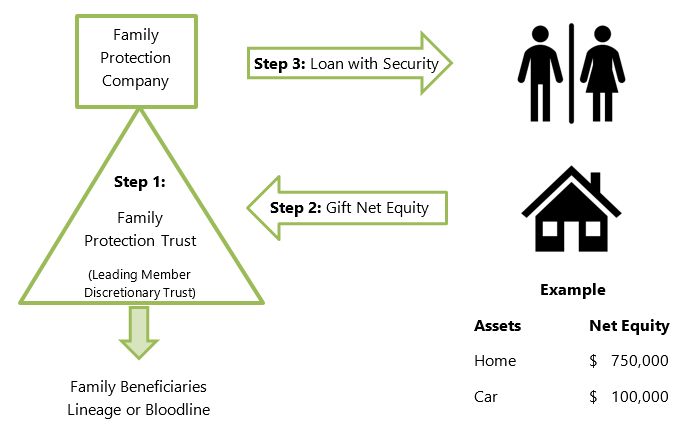

“The Protector” is an asset protection strategy, which provides both asset protection and ensures that your assets are held for the benefit of your desired beneficiaries in your lineage or bloodline. This helps with keeping your hard-earned assets in the hands of your lineage, whilst also protecting against creditors.

“The Protector” involves the establishment of a special purpose trust (a Leading Member Discretionary Trust) for the beneficiaries of your lineage or bloodline that you desire, including yourself and your spouse. We refer to this as a “Family Protection Trust”. It is effectively your family’s long-term wealth vault.

If you were to transfer any properties held in your name to a Family Protection Trust, it would incur stamp duty on the current property values and you would be assessed capital gains tax on any capital gain on investment properties.

Using “The Protector”, you can protect the value of your property assets without incurring stamp duty or triggering any capital gains tax payable.

There are 3 key steps:

The end result is that your net equity in the assets that you choose is now held by your Family Protection Trust and is not in your name.

With little or no assets in your personal name, most lawyers would not bother trying to take legal action against you, because even if they win you do not have any assets in your name that could be taken as a legal settlement. To illustrate how this concept works, please refer to the below diagram:

It is important for you to understand that strategies which are implemented to transfer assets at or immediately prior to insolvency are ineffective. It is too late to undertake asset protection strategies when creditors are “knocking at the door”.

The Bankruptcy Act protects some transfers from being voided when both of these conditions are present:

If “The Protector” strategy were to be implemented, then any assets transferred into the trust would be subject to the above Bankruptcy claw back provisions, so the sooner we undertake “The Protector” asset protection strategy, the better.

If you have concerns about how the recent Federal Court decision in the Commissioner of Taxation v Bosanac [2021] FCAFC 158 will jeopardise your current asset protection strategies, then our specialist team can help.

You can contact us on 08 94275200 or at ExperienceSuccess@munros.com.au.

—

(You can also watch the video on YouTube here: https://youtu.be/IHHo5uxAE8s)

Do You Thrive To Learn More About How To Achieve Greater Business Success?

Sign up to our magazine designed specifically for Australian business leaders.