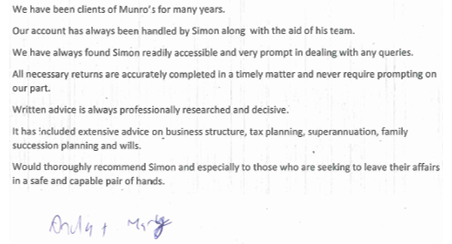

We are delighted with the friendly, knowledgeable and efficient service Simon and his team provide.

We have tested Simon’s patience and humour over the years but he has always managed to come through with a smile.Thank you to Simon and his team!

Magazine

Do You Thrive To Learn More About How To Achieve Greater Business Success?

Sign up to our magazine designed specifically for Australian business leaders.