Magazine

Do You Thrive To Learn More About How To Achieve Greater Business Success?

Sign up to our magazine designed specifically for Australian business leaders.

You are here: Home » Blog » Accounting » ATO Crack Down on Family Trust Distributions

Published on 8 March 2022

by Saul Segal

Categories: Farm Advisory, Business, Accounting, Wealth

The ATO has been trying to crackdown on the use of trusts for many years and has recently released the following draft ruling, guideline and taxpayer alert relating to trust distributions that have associated reimbursement agreements:

These could have major implications on how your family trust, if you have one, distributes income, together with the amount of tax your family will pay.

Broadly, section 100A is an income tax anti-avoidance provision that may apply when a trust beneficiary is made presently entitled to (i.e. distributed) a share of income of the trust estate that arose out of, or in connection with, a reimbursement agreement, being an arrangement:

When the rule applies, the trustee (and not the beneficiary) is liable to pay tax on the income at the top marginal tax rate (currently 47% including Medicare Levy).

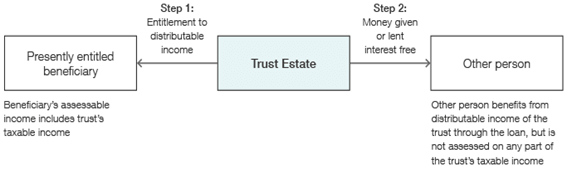

A ‘reimbursement agreement’ involves trust distributions to low taxed family members or family companies where the benefit of the distribution is diverted away from the beneficiary to another family member who would otherwise pay a higher rate of tax if it was distributed directly to them as illustrated in the below diagram:

For many years, it has been common practice by business owners and investors who use Family (Discretionary) Trusts to look to spread trust income across family member beneficiaries. Trust distributions are often made to adult children for asset protection and estate planning purposes.

Sometimes, the adult children in a family may have lower tax rates than their parents, so the overall tax rate % for the family group is lower as a result of the spread of these trust distributions.

Under the new Taxpayer Alert, the ATO is reviewing the above trust arrangements only when the parents enjoy the economic benefit of trust income appointed to their adult children.

This may typically involve family trust arrangements where the parent’s adult children are made presently entitled to trust income, but the income is used to meet the expenses of the parents. The entitlements are then ‘satisfied’ by the children directing that the amounts be paid to their parents or applied against any beneficiary loans owned by the parents (i.e. gifting).

Under the arrangement, the parties may try to argue the children are required to repay their parents for their share of family costs or for expenses incurred in relation to their upbringing (e.g. private school fees and uniform costs, or their share of family holidays). However, the ATO is concerned taxpayers are entering into these arrangements to access tax-free thresholds and lower marginal tax rates of family members, rather than ordinary family dealings.

In these arrangements the ATO plans to, for tax purposes, invalidate the trust distribution and tax the trustee of the trust at 47% on the amount of the distribution, and they may charge penalties on this as well.

However, in example 3 of the Taxpayer alert, the ATO states that section 100A will not apply where the adult children’s current year expenses are paid directly by the trust. For example, the payment of university tuition fees or rent/board of the adult children.

The changes not only affect distributions to adult children, but also distributions to extended family members such as to parents, parents-in-law, daughter & son-in laws, nieces and nephews whereby they are not actually receiving the benefit of the income they have been distributed.

It is important to stress that the draft ruling, guideline and taxpayer alert is only the ATO’s interpretation of the law. This means that it is not binding on taxpayers to comply with the above views, but merely a guideline to determine whether or not the ATO may take a closer look at your situation.

There is a significant amount to play out with all of this, and no doubt there will be a great deal of debate, and most likely Case Law in future, about what is “ordinary family dealings”.

Going forward, it is more important than ever for Trustees to keep contemporaneous records, to support the following:

If you have concerns about how the new draft ruling, guideline and taxpayer alert relating to trust distributions that might be subject to a reimbursement agreement, our specialised team is able to help.

You can contact us on (08) 9427 5200, or by emailing your usual contact at Munro’s, or emailing ExperienceSuccess@munros.com.au.

Do You Thrive To Learn More About How To Achieve Greater Business Success?

Sign up to our magazine designed specifically for Australian business leaders.